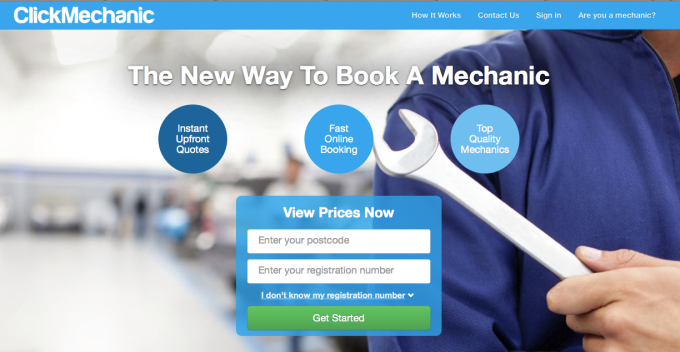

In the second part of our Importance of Funding series, we hear from Andrew Jervis, Co-Founder of ClickMechanic, who recently announced a top up to their seed funding round

https://www.clickmechanic.com/

As outlined by Nezahat Gultelkin in her recent piece on Tech City UK’s blog about ‘The Importance of Funding’, the macro impacts of a healthy flow of venture investment into London are clear for all to see. According to Nezahat’s analysis, in 2014 there were 10 tech IPOs in the UK raising £1.7bn proceeds and representing a £5.3bn market value at the time of IPO. Without venture investment, none of this would have been possible and thousands of jobs would not have been created.

But how is funding significant a micro level to an early-stage startup that is battling to get cut through in a cluttered market and raise that all important capital?

As any reasonable business brain will tell you, cash flow is the lifeblood of any successful startup and without it, you die. The problem with many technology startups is that they don’t make much cash at an early stage and only become the large revenue generating machines we’ve become accustomed to seeing at scale.

Any online marketplace is a case in point. Marketplaces often make small commissions (approx 10%) on the transactions they put through and if, for example, we look at a takeaway marketplace where an average basket size may be £20, the company is only making £2 revenue on that transaction before marketing, operational and other costs are factored in. The only way to scale these types of businesses – as well as most future tech stars – is through funding.

Some may argue that successful startups can be bootstrapped which is certainly possible but if you look at the major success stories the vast majority are venture backed. Furthermore if your idea is remotely attractive and showing some signs of success there will be other bigger and better funded fish around the corner copying your idea, improving it and hiring the right talent to outshine you. Failure to move quickly – even with the best ideas – can mean failure to execute.

Just as important as raising investment is raising the right type of funding in those early days. In 2013, we were offered four terms sheets, each with varying sums of money/T&Cs. We ended up taking the smallest amount on a convertible note. Why? Any investment is about economics (amount of cash and valuation) and control (investor rights). It just turned out that we believed strongly (as the famous Steve Blank does) that an early seed round should not be about control but enabling and supporting the founders to build their product, and get product market fit as soon as possible.

Big term sheets with multiple caveats, investor protections and board seats were a red flag for us at that stage. Instead, we have an amazing group of angel advisors who are there for us when we need them, so we still get all the upsides such as advice and support but without any of the formal baggage of snoozy board meetings etc.

It’s a seriously exciting time in UK startup history with so many great entrepreneurs launching awesome products, all backed by a supportive ecosystem with plenty of smart investment money. The key is sealing the right deal that will help you get to where you need to go.