A new report from Fundacity has shown that UK accelerators are streets ahead in Europe when it comes to investment

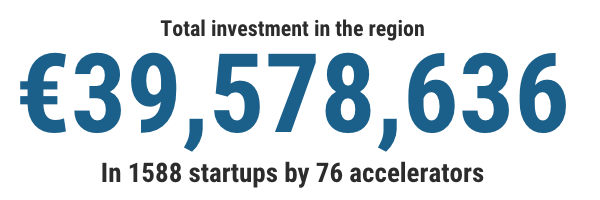

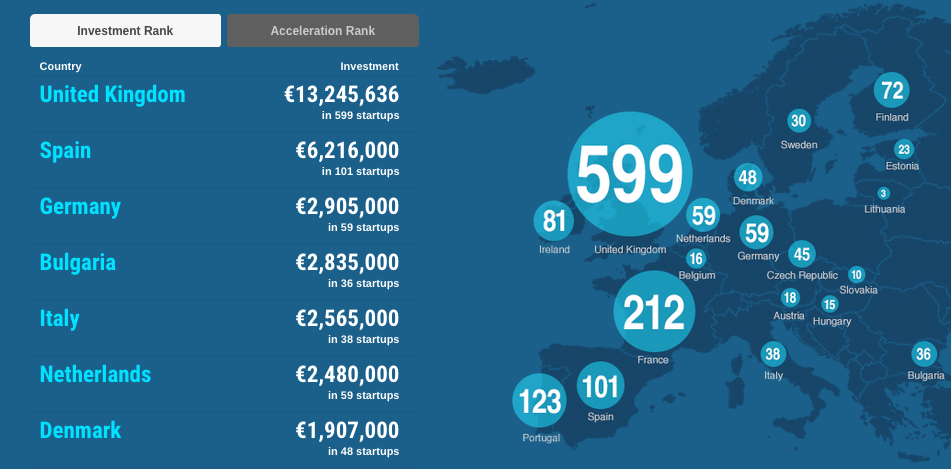

The European Accelerator Report 2014 from Fundacity has revealed the extent of investments made and startups accelerated by accelerator programmes across Europe. The data collected shows the strength of UK support mechanisms for tech startups, with 599 startups accelerated in 2014 via accelerator programmes.

France comes in at number 2 with 212 startups accelerated via programmes. The ecosystem is still nascent, with lower investment levels compared to the UK. The research shows the investment level for the UK was at €13,245,636, invested into startups through accelerators, with Entrepreneurial Spark, Wayra Europe, Accelerator London and Accelerator Academy topping the list of programmes with a UK presence.

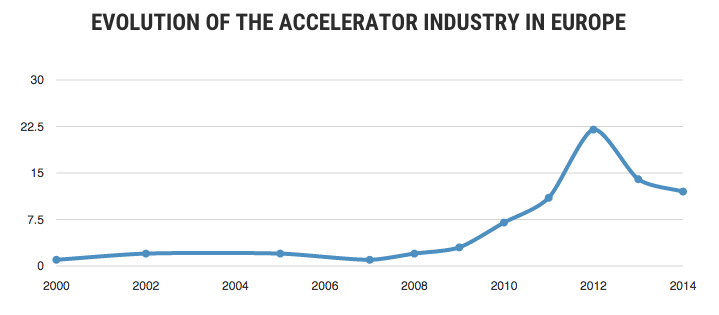

Noticeable omissions from the list of accelerators analysed as part of the study include Seedcamp and Techstars, both leaders in the tech acceleration space throughout Europe The report also provides a summary of the last 10 years of accelerator history.

76 out of 128 accelerators contacted across Europe were analysed. These fantastic numbers demonstrate there is a huge amount of support for young companies right across the continent. The definition of ‘accelerator’ used for the purpose of the report was originally given by Miller and Bound (2011) who distinguish accelerators from incubators by five features:

1) An application process that is open to all, yet highly competitive

2) Provision of pre-seed investment, usually in exchange for equity

3) A focus on small teams not individual founders

4) Time-limited support comprising programmed events and intensive mentoring

5) Cohorts or ‘classes’ of startups rather than individual companies

Read more about the report and the accelerators that provided information for it here.