Silverpeak’s M&A, Growth Equity and IPO report on the European Internet industry 2016 gives reason for optimism in the UK’s tech sector, both for 2016 and moving forward.

Following a brief dip in M&A deals in 2015, the number of deals is rising again, after picking up in 2016. Although slightly below the record number of deals in 2014, we have seen over 20 deals of more than €100m transaction size each, with the UK leading the way in Europe.

In spite of the number of large deals, as the internet industry continues to mature, 2016 was marked by an extraordinarily high number of small deals, a trend expected to continue in 2017.

The European Internet Industry – Overview

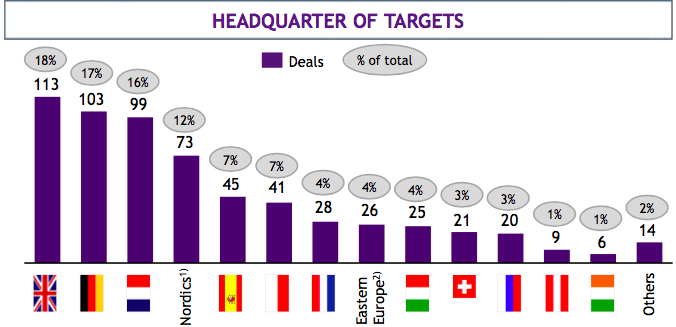

The UK returned to the European top spot in 2016 – for M&A activity – following Germany’s leading position in 2015. Interest in German internet companies decreased by 22%, and although the UK deal count fell too – from 116 to 113 – the UK ranked top.

This dominance reflects the vast amount of attention from US companies in particular. International deal flows to the European Internet industry in general rose again in 2016, with the UK the leading target from international buyers. China and Hong Kong in particular, who are the parvenus amongst buyers as their deal count tripled, and they produced some of the highlight deals of the year including the acquisition of Skyscanner, sold to Ctrip.com for $1.7bn in November.

Large European Internet Fundraising – Trends and Observations

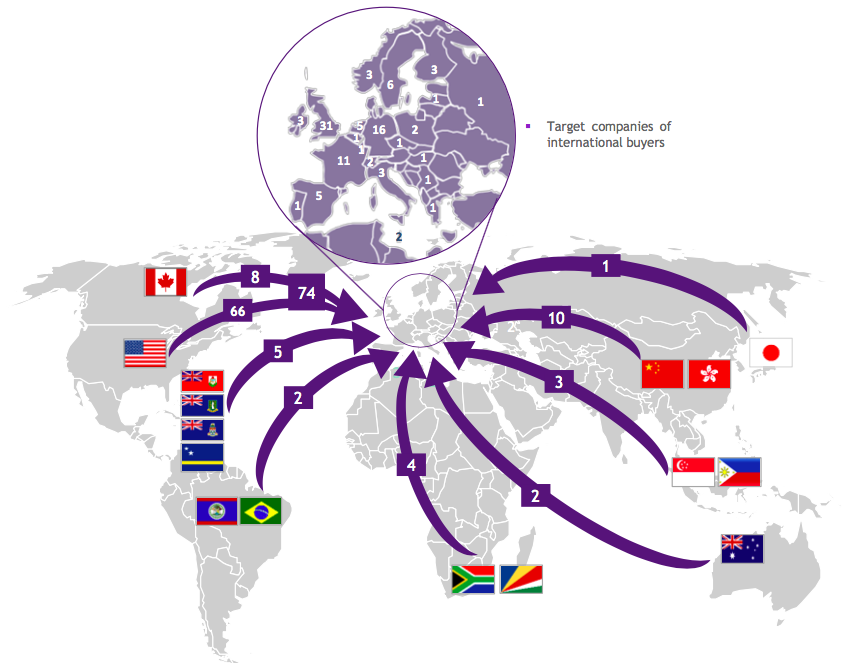

FinTech in particular sees a domination of the market in the UK, alongside Germany. Together they are the most popular destinations for B2C FinTech investments, accounting for a combined 80% of deals (and 70% of deals in B2B FinTech).

However, FinTech was not the only sector which saw large investments, there was also an increase in investment across the industries, including eCommerce with Future Fifty company Farfetch receiving the largest investment in Europe at €97.3m, whilst in the travel industry search platform Skyscanner similarly received the largest investment at €176.7m.

UK M&A Trends – 2016

Last year saw the UK’s attractiveness as a destination for global investment rise, with notable transactions including market pricing data provider Markit selling to HIS ($5.5bn) in March, home rental service and Future Fifty company Onefinstay selling to AccordHotels ($170m) in April, and of course Skyscanner.

Thus far, the Brexit vote appears to have little impact on M&A in the UK, with cheaper asset prices (due to the pound being 20% lower) compensating the unknowns of the UK leaving the EU.

The Skyscanner deal was of particular note in the year, being not only an incredible return for a business founded by three Manchester University graduates back in 2003, but also because of its acquirer, Chinese group Ctrip. Europe is of particular interest to China as it is not subject to the same onerous CIFIUS (Committee on Foreign Investment in the United States) approval process as in the US.

Overall Observations

The UK remains at the forefront of investment in European internet based industries, in part due to its domination of the FinTech sector alongside Germany, supported by firms in other industries such as eCommerce and travel in particular. As investment from the East continues to rise, there is serious reason for optimism in the UK’s internet industry going forwards.