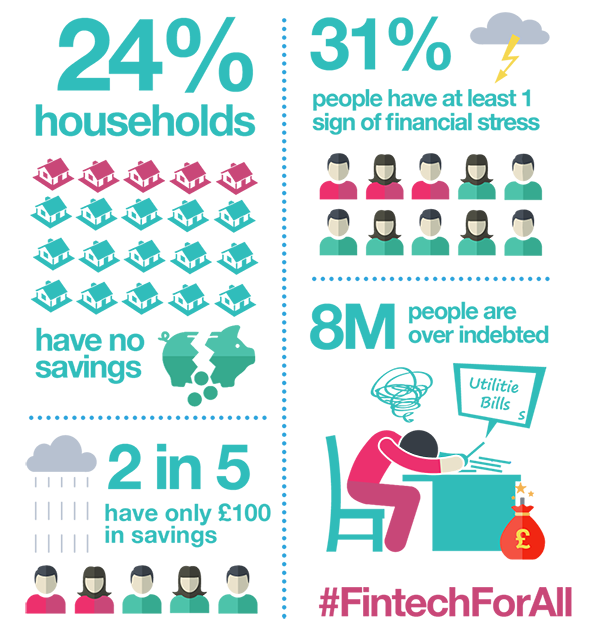

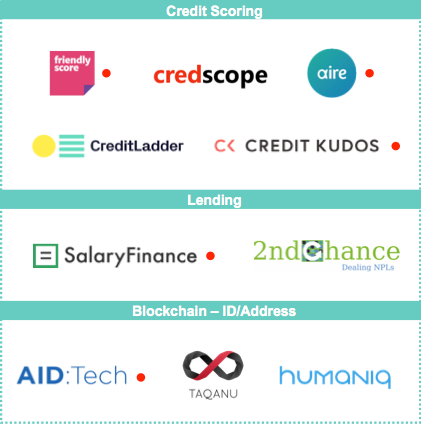

1. Facilitate access to financial products through innovations in credit scoring and ID/address

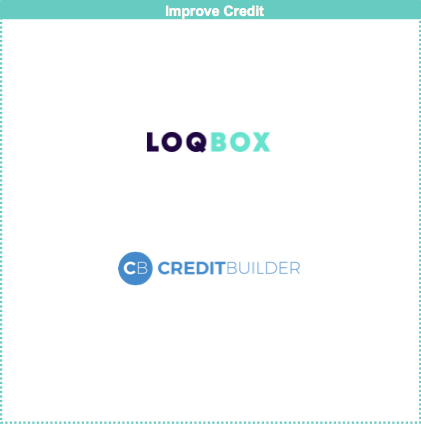

2. Understand and manage

credit better

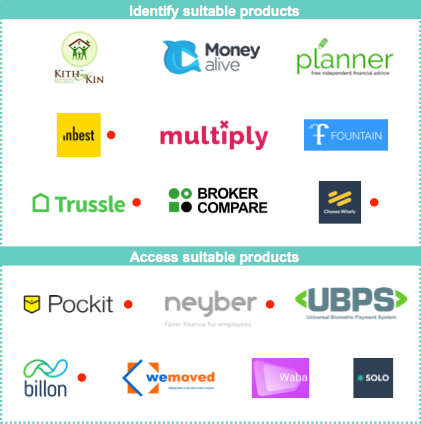

3. Identify and access more suitable financial products

4. Start actively saving and plan for the unexpected

5. Gain access to

insurance services

6. Confidently manage money and track day-to-day financial transactions

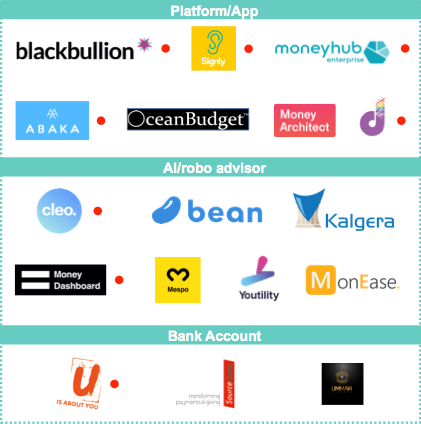

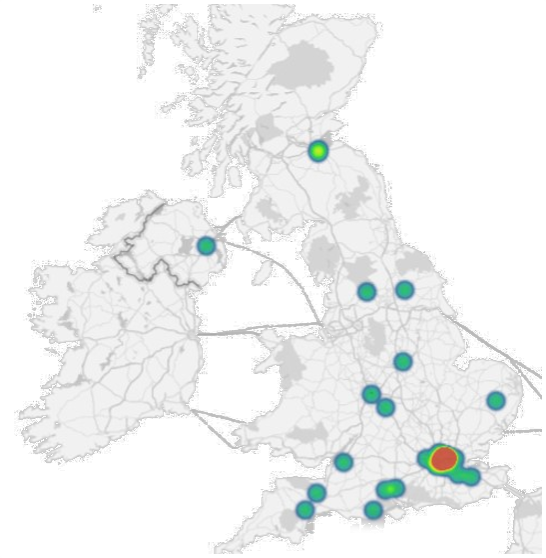

The competition was open to (1) Established Fintechs and (2) Newcomers. In the map above the red dot signifies Established Fintechs: B2B companies with more than 3 customers or B2C companies with more than 5,000 customers. Newcomer fintechs (no dot) were defined as B2B companies with 3 or less customers or B2C companies with less than 5,000 customers.

1. Bean

2. Bridge Housing Solutions

3. Broker Compare

4. Chip Financial

5. Chip In

6. Credit Builder

7. Credit Ladder

8. Credscope

9. ECSIF

10. Family Investments

11. Fountain

12. Hatch

13. Humaniq

14. Kalgera

15. Kith & Kin Financial Wellbeing

16. Lifetise

17. LOQBOX

18. Mespo

19. MonEase

20. Money Alive

21. Money Architect

22. Moneybox

23. Moola

24. Multiply

25. OceanBudget

26. Savewallets

27. SOLO

28. so-sure

29. SourceCards

30. Taqanu

31. NoMo (The ID Co.)

32. uMind

33. Ummah Finance

34. Universal Biometric Payment System

35. Waba

36. WeMoved

37. Yoomee

38. Youtility

39. ABAKA

40. AID:Tech

41. Aire

42. Billon Group

43. Blackbullion

44. Boring Money

45. Choose Wisely

46. Cleo AI

47. Credit Kudos

48. U-Account (Ffrees Family Finance)

49. FriendlyScore

50. Investment Solver

51. Money Dashboard

52. Moneyhub Entperprise

53. Neyber

54. Oval Money

55. Plum

56. Pockit

57. RoosterMoney

58. Salary Finance

59. Signly

60. Squirrel Financial Wellbeing

61. Trussle

62. We Are Digital

63. Wealthsimple UK

A Pockit account takes just two minutes to open and comes with an online account, contactless MasterCard and mobile app. There are no credit checks, just a simple, online form, and a one-off payment of 99p. An account with Pockit comes with all the benefits of modern day banking including, pay-in capabilities at over 28,000 pay points across the UK, local and international money transfers and is open to all, especially those shut out or short-changed by traditional high street banks. Pockit are currently serving over 200,000 representing an annual transaction value of £250m.

Pockit tackles financial exclusion by providing a bank account for people who are currently excluded or who don’t want to use basic bank accounts. Innovative approaches to ID widen access for customers and clear, transparent fees mean consumers feel in control rather than in their overdraft.

“We were really impressed with the quality of the pitch and the well articulated business model” – David Haigh, Executive Director for UK Financial Capability, Money Advice Service

“In a fiercely competitive sector – filled with legacy operators and new entrants, Pockit has managed to stand out due to its clear value proposition and ability to solve a real issue. All ingredients to create a sustainable business. As an investor we are looking to back companies that fulfil a real need, addressing a huge market and with a founder who is ambitious. Pockit ticked all the boxes. Any early stage investment is a journey. This particular journey has given us the opportunity to watch a business, a management team and proposition blossom – turning a great idea into a great business.” – Concentric Ventures

Mespo is the only fully independent robo money saver, detecting and executing savings opportunities for consumers.

Mespo analyses a customer’s bank account and spots cost savings potential such as lowering energy bills. Mespo then automatically lets the user choose from all available options in the market by categorising over 5000 merchants and performs the switch on the customer’s behalf while monitoring it on an ongoing basis for further savings.

Mespo achieves average yearly savings on energy alone of £308 and plans on extending their offering to other recurring payments such as phone, TV and broadband bills.

Mespo helps customers save money on their household bills. Switching can be time-consuming but Mespo makes it easy and aligns its success with that of its customers – charging a 10% fee only on the savings customers make. This means that people with low financial capability can save money and identify more appropriate and cost-effective products.

“It’s a win win between their customers and themselves. Something I would use myself” – David Brear, CEO & Co-Founder, 11:FS

“Digital technologies applied to financial services have demonstrated how powerful they are in supporting financial inclusion both in emerging and developed countries.

This is why I have been working with Lukas and Mespo since the very early stages. Mespo does indeed provide a very important solution for users to take back control over their finances and make better, more informed, objective choices. It demonstrates how digital technologies can be harnessed to not only be commercially successful but also socially helpful.“

– Jean-Stephane Gourevitch

From left to right: Fahd Rachidy (Abaka), Dr. Dexter Penn (Kalgera), Maxie Sofos (Credscope), Richard Trainor (Pockit), Laura Coffey (Tech City UK), Aneesh Varma (Aire), Lukas Zoerner (Mespo), Nathaniel Jowitt (Tech City UK), Greg Michel (Tech City UK)

There are 3 main areas that contribute to more expensive insurance for low income households. First, low-income families often live in high crime-rate areas, which carries a geo-based insurance premium. Secondly, direct debit payment for goods and services are typically more expensive compared to lump sum (up to 20% more than annual fee). Lastly, there is a higher rate of physical and mental health problems associated with poverty and these carry insurance premiums.

Of course, insurance services are inherently based on risk, which makes it difficult to have truly inclusive and equal costs. However, we think that fintech entrepreneurs should consider building new solutions using new ways of measuring and assessing risk – similar innovations to those we have seen in credit scoring. Additional data could be used to inform costs, for example a consumer living in an area with a high crime rate could benefit from not having a criminal record or a greater weighting could be given to customers who don’t make a claim. Solutions should aim to spread costs and not include a premium for those paying monthly.

Low income households are generally good at budgeting but require help with managing and sectioning out money for priority goods and services. Missing payments for rent and bills causes people to become indebted and costs landlords and Housing Associations significant time and resource chasing down late payments.

We would be interested in seeing fintechs working in this space devising solutions that consider how to incentivise each layer of payments to help people better manage their money. For example, if tenants paid rent on time, they could receive cashback from housing associations who’ve saved from the money they normally spend tracking late payments. This could then filter down as credit to their next layer of payments like energy bills and the incentives flow down the chain from priority payments to treats and luxury items.

At BGV we believe that a different approach is needed to improve take up from people with low-income backgrounds. Solutions should be focused on those who are currently underserved and should seek to increase both the speed and ease of insurance payments. This is very important for low income households who may not have appropriate back up reserves for emergency payments situations. Reducing these potential burdens would increase access to insurance services.

The time and difficulty in accessing insurance and obtaining pay-outs can often act as a barrier resulting in people forgoing insurance and facing large risks. At Bethnal Green Ventures we have often seen entrepreneurs try to use an existing business model that works for a high income population and repurpose it with new branding to the low income demographic. This typically ends up being the same thing but marketed differently and does not serve the correct purpose.

We are looking for the development of more personalised solutions which comprise additional data sources, such as those we have started to see in credit scoring. Such solutions would benefit those with low income backgrounds, many of whom are financially excluded, allowing them to prove who they are and gain access to the financial services from which they are currently blocked.

ID and address requirements are central to financial inclusion because they act as a gateway to accessing financial services. Although innovations in technology have allowed companies to perform simpler and more accurate ID/address verification services, there is still a large demographic who are unable to pass these verification tests due to the traditional view of identity and a corresponding lack of appropriate documentation.

We’d be excited to hear from entrepreneurs who are looking at how to accurately forecast user spend to enable people to better save their money and effectively plan in the longer term. One potential solution could be to use a Big Data approach on a person’s historical transactions coupled with behavioural analysis of their day-to-day money management to produce a forward-looking product. Aiming to predict future spend and cashflows, such a product would increase the visibility that a consumer has on their financial state as well as the future impact of their financial decisions today.

Whilst there have been many attempts at helping people to budget and track their spending habits by tapping into their current accounts and categorising their outgoings, simply tracking transactions is not effective enough as a planning tool. Few solutions have been able to accurately predict spending in the future, which is in part due to a lack of expertise in behavioural psychology.

We would like to see fintechs solving this through bundling services. For example, a savings app might look to offer credit scoring and a current account onto their core services, generating multiple revenue streams. To increase their reach and bundle their offering, startups today attempt to partner with incumbent financial services providers. But whilst lucrative when a partnership is successful, these large companies do not always see the value in small, one-off investments and this can often prove to be a struggle. We would encourage fintechs to look for other, unorthodox partners outside of financial services whose existing userbase overlap with the startups target demographic. For example, partnering with the equivalent of Walmart in the US would open the door to millions of potential users.

There is currently a lack of diversification of products targeting the low-income, unbanked or no credit population. Two key challenges to this are: making the economics work at scale and reaching those that are underserved or untouched.

A Fintech For All Judge, Vice Chair of the Financial Inclusion Commission and a member of the Fintech Delivery Panel

“Financial inclusion is about ensuring that every adult in the United Kingdom is connected to the financial ‘mains’, just as he or she is connected to mains electricity or mains water. The Financial Inclusion Commission wants financial services that are accessible, easy to use and meet people’s needs over their lifetime. That means access to banking and payment services, insurance, savings and affordable credit.

Yet 14 million people have insufficient means to see themselves through the next month if they are hit with an unexpected shock – illness, unemployment or family breakdown. A third have no savings at all. And up to 2 million don’t even have a bank account.

Read More

MD, Partnerships and Propositions at Experian, sponsors of the Experian Spotlight Award

“We would love to speak to anyone in the fintech community who is interested in working with us to help transform the future of finance.”

Access to affordable financial services is an important part of everyday life, but with traditional financial products generally under-serving the market, it’s important that we look to innovation to find new solutions, creating financial services products that work for everyone.

The rise of fintech in the UK is transforming the way we all manage money. The sector is a hive of invention, delivering great new ideas that are changing traditional services. As the digital world continues to evolve, there’s no doubt that new and exciting innovations will continue to enter the marketplace.

Read More