UK Government Chief Scientific Advisor Sir Mark Walport has released a report on both the past and future impact of FinTech on the UK economy

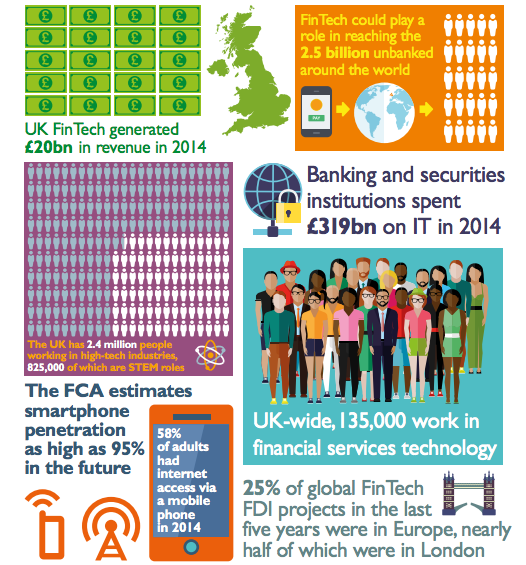

The report confirms what many of us were already thinking, the UK is leading the rest of the world in creating exciting and profitable FinTech companies. In 2014 alone, UK FinTech generated over £20bn of revenue with some 135,000 people working in the sector across the UK.

With the UK a world leader in global finance, it was only fitting that it should become the home of technological innovation which not only makes finance easier, but infinitely more efficient. The success of the space was evident late last year with 6 of the 12 new companies accepted onto the Future Fifty programme offering FinTech solutions.

Of global FinTech FDI projects in the last five years, 25% were in Europe and half of these were in London. The report highlights the ways in which FinTech will be influenced and indeed boosted by other emerging technologies over the course of the next decade:

1. Machine learning and cognitive computing

2. Digital currencies and blockchain

3. Big data analytics, optimisation and fusion

4. Distributed systems, mobile payments and peer-to-peer applications

Amongst the ten recommendations proffered in the conclusion of the report were the need to form advisory groups to monitor risks to the sector; create higher education courses for FinTech; and cultivate regulatory infrastructure or ‘regtech’ in order to protect consumers from the misuse of the technology.

Read the full report here.