London hosted 22,000 Meetups in 2016 – 3X times more than any other European city

The UK’s digital tech ecosystem

What makes a digital tech economy successful? Capital and talent, yes, but also accelerators, affordable co-working spaces and experienced mentors.

The face-to-face networking that these enable is hugely important to the growth and success of digital businesses.

Digital tech innovation across the country is helping to strengthen local economies and make the UK’s business environment even more dynamic and productive.

Tech Nation 2017 profiled 30 digital tech clusters across the UK. These clusters are the building blocks of the UK’s digital tech economy.

| Digital Tech Density | Digital Tech Turnover (£bn) | Turnover Growth (2011 -15) | High Growth Businesses |

| Reading 7.26 |

London £56bn |

Dundee 171% |

Bournemouth & Poole (26%) |

| Bristol & Bath 4.35 | Reading £12.5bn |

London 106% |

Newcastle (22%) |

| Cambridge 1.79 |

Bristol & Bath £8.1bn |

Sunderland 101% |

London (20%) |

| Southampton 1.57 | Manchester £2.9bn |

Bristol & Bath 87% |

Glasgow (19%) |

| Oxford 1.53 |

Cambridge £2.1bn |

Edinburgh 85% |

Brighton (18%) |

Source: ABS / BSD, Tech City UK, 2015. Based on turnover per worker (ABS / BSD, 2015)

Average UK Cluster Performance (2011 – 2015)

| Performance | |

| Digital Tech GVA | 93% |

| Digital Tech Jobs | 93% |

| Digital Turnover | 89% |

| Digital Tech Productivity | 60% |

Source: ABS / BSD, Tech City UK, 2015. Based on turnover per worker (ABS / BSD, 2015)

London hosted 22,000 Meetups in 2016 – 3X times more than any other European city

Meetup, an online portal that facilitates networking, also generates data which can be used to indicate the strength of networks within Europe’s digital tech hubs.

In 2016 nearly 22,000 tech Meetups took place in London. That is nearly three times more than in Berlin, Amsterdam or Paris.

Meetups in European digital tech hubs

| City | Number of Tech Meetups (2016) |

| London | 21866 |

| Berlin | 7963 |

| Amsterdam | 7915 |

| Paris | 7581 |

| Oslo | 3490 |

| Zurich | 3373 |

| Barcelona | 3286 |

| Madrid | 3225 |

| Munich | 3012 |

Source: Meetup, 2016

The greatest number of Meetups outside of London were in Bristol & Bath, followed by Reading and Cambridge.

Meetups in UK clusters

| City | Number of Tech Meetups (2016) |

| London | 21866 |

| Bristol & Bath | 3909 |

| Reading | 3600 |

| Cambridge | 2698 |

| Manchester | 2192 |

| Worcester & Malvern | 1899 |

| Bournemouth & Poole | 1394 |

Source: Meetup, 2016

The largest concentration of JavaScript, PHP, Python and Java MeetUps all took place in Bristol & Bath, indicating that this cluster is a networking powerhouse.

85% of digital tech businesses made use of services in their local ecosystem, mentoring from expert peers and co-working spaces are the most valued

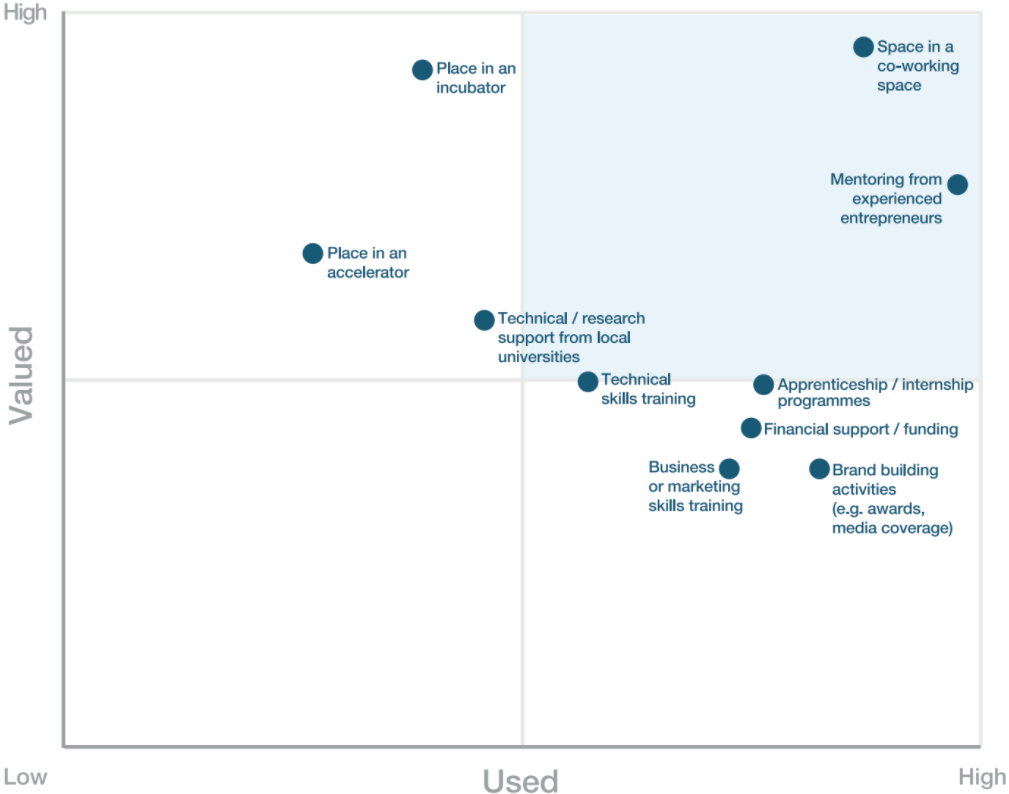

When we asked digital tech businesses across the UK which aspects of their local ecosystem they used, the three most popular responses were: mentoring, brand building activities (awards, for example) and co-working spaces.

Only 15% of the digital tech businesses we surveyed had made no use at all of local support systems, highlighting just how important they have become. Intriguingly however, the services that digital tech businesses use are not always those they claim to value most highly. As the analysis below shows, while incubator and accelerator services are valued highly, take-up for their services remains relatively low, suggesting that more could be done to promote and support them.

Source: Tech Nation 2017 survey

Over 25% of the digital tech community highlight poor digital infrastructure as challenge to doing business

| City | Digital Infrastructure as a business challenge (%) |

| Glasgow | 55% |

| Dundee | 45% |

| Brighton | 42% |

| Norwich | 42% |

| Ipswich | 38% |

| Worcester & Malvern | 38% |

| Liverpool | 36% |

| Sheffield | 33% |

Source: Tech Nation 2017 survey

Over a quarter (28%) of digital tech community members cited poor digital infrastructure as a business challenge.

Perhaps surprisingly, this is not an exclusively rural issue. In fact, some of the highest proportions of dissatisfaction were in large cities such as Glasgow (where 55% say it is a challenge), Dundee (45%) and Brighton (42%).

The clusters which performed best on this rating were Sunderland and Nottingham where only 9% and 11% of businesses cited digital infrastructure as a business challenge.

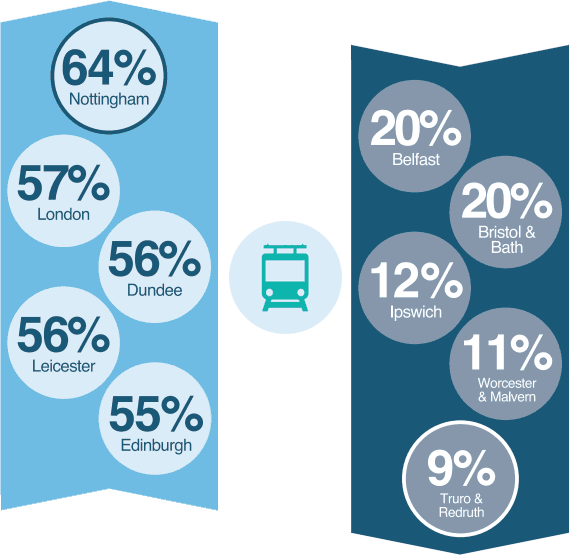

30% of digital tech community members cited their local transport infrastructure as a business challenge

On local transport infrastructure cities performed better than rural areas.

While over a third (36%) of respondents rated their local transport infrastructure as good, ratings tended to be higher in larger conurbations.

Source: Tech Nation 2017 survey

50% of digital tech business rate their local digital economy as strong

In our survey, we asked members of each cluster to rate the strength of their local digital tech economy. Just over 50% rated it as ‘strong’.

In Bristol & Bath, Bournemouth & Poole and Brighton this figure rose to around 90%.

At the opposite end of the spectrum, the figure fell to only 25% in Leicester, 31% in Birmingham and 35% in Southampton.

| City | Strength of local digital economy |

| Bristol & Bath | 90% |

| Bourenmouth & Poole | 89% |

| Brighton | 88% |

| Cambridge | 86% |

| Edinburgh | 78% |

| Dundee | 75% |

| London | 72% |

Source: Tech Nation 2017 survey

THE UK DIGITAL TECH COMMUNITY IS UPBEAT ABOUT GROWTH: 75% feel optimistic about their cluster’s growth potential

| City | Digital Infrastructure as a business challenge (%) |

| Cambridge | 95% |

| Brighton | 92% |

| Leeds | 92% |

| Edinburgh | 92% |

| Bournemouth & Poole | 91% |

| Bristol & Bath | 88% |

| Dundee | 86% |

| Manchester | 85% |

| Glasgow | 81% |

Source: Tech Nation 2017 survey

There was an overwhelmingly positive response when we asked respondents to rate their cluster’s potential for growth.

Over 75% rated theirs as ‘good’, while just 8% described it as ‘poor’. Those in Cambridge have the sunniest outlook, (95% saying that growth potential is ‘good’), while at 92% the mood is almost as upbeat in Brighton, Leeds and Edinburgh

These are reasonably encouraging findings, though they do indicate significant regional variation when it comes to perceptions of the progress made in digital tech.